To rent or buy – that is the question

With prices cooling in the east coast property market and the Western Australian property market still struggling to build momentum, the process of deciding to buy or rent has never been more relevant.

Like any financial decision, there are pros and cons associated with buying or renting. We discuss some of the important considerations when deciding whether to rent or buy and look at which one has really worked out better over the long term in Australia.

Buying Residential Property

The Pros of Buying

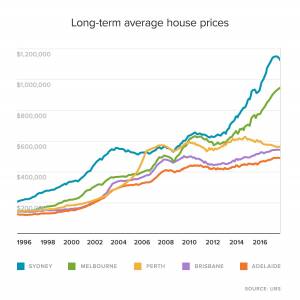

1) The rise in prices over time.

It hard to dismiss stories of people making fortunes as a result of rising prices in residential property. Sydney property prices increased more than 70% between 2013 and 2018. Benefits of longer-term ownership include capital gains offsets and exemptions for your primary place of residence.

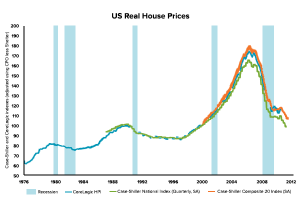

There are plenty market players who have the opinion that property values only increase, however there have been examples of weak growth or declining values, for example in the US, residential property fell by an average of 33.8% during the global financial crisis.

In times of softening markets, residential property investors need to be prepared to cope with reducing house values and the effect this can have on their personal financial position.

2) You can utilise debt to purchase residential property.

Australian banks have historically provided lending to a range of investor types to invest in residential property. Australian banks often lend quite large amounts against the value of a property which means you can purchase an asset well above your cash backing if you are able to service the interest and principal repayments.

For instance, it’s typical to contribute a 20% deposit and the bank mortgage covers the remaining 80%, or an 80% Loan to Value Ratio (LVR). Let’s say you buy a property for $1,00,000 with a deposit of $200,000 and borrow the remaining $800,000. If you sell the property a year later for $1,100,000, the property itself has risen 10% in value but your return on investment is 50% (ignoring interest and other costs) since you have made $100,000 profit on the $200,000 original deposit. It’s worth noting that after transaction costs, interest and principal repayments, the actual return is likely to be much lower. Also, the opposite would be true if the house price fell from $1,000,000 to $900,000. Your profit would be -50% or worse after repayments and costs are accounted for.

3) The soft or intangible benefits of buying a property.

When you purchase your own property you also secure your place of residence, so you won’t be susceptible to a landlord kicking you out and you have the flexibility to modify or renovate your property.

Cons of buying

1) Interest repayments.

Many people say rent money is dead money, the same can be said for the interest component of repayments. If you had an $800,000 mortgage and million-dollar house, and your interest rate was 3.75% then you would be paying about $30,000 of interest a year, which would be a similar amount in rent for similar property per annum.

In saying this, interest rates are at all time lows and there is a good chance interest rates will increase at some time in the future. The RBA estimates that long term variable interest rates are about 6.20% which means the longer-term interest repayments would be $49,600, which is large increase in interest repayments from where they are now.

2) Opportunity cost.

This is very rarely assessed and refers to the cost of having your money tied up in property versus being able to use it elsewhere and the returns you could generate. For example, in the bank (approx. 2% per year), a diversified portfolio (historically 8% per year) or other investments.

3) The costs associated with ownership.

There are several costs associated with purchasing and then holding a property. When purchasing, you need to pay stamp duty, conveyancing, building inspections etc. The costs of holding can include land tax, council rates, water rates, insurance etc. When selling, costs can include agency fees, marketing etc.

Renting

Pros of renting.

1) Free up your savings.

Renting frees up your savings to earn a return elsewhere and depending on where those savings are invested, they may be able to earn a higher return than would be possible in property with the money that’s been freed up.

2) Flexibility.

While owning a property provides more stability, renting gives more flexibility. This can be attractive to young singles and families who need to move for work or want to live in a more desirable location during a certain period of their life.

3) Opportunity for Diversification.

Investing in residential property is generally the first big investment an individual makes in their life. One property, in one suburb, in one city, in one country. That’s a lot of your total wealth riding on a single investment that can be impacted by a whole list of factors outside your control. Renting allows you to spread your risk across a much broader range of investments.

Cons of renting

1) The costs associated with renting.

While renting may seem expensive, rental yields are at historic lows. Rent is the equivalent to interest you pay on a mortgage. It’s the cost of borrowing for an asset – in the case of renting, the asset is a property whereas for a mortgage you’re borrowing money.

2) No forced savings.

This is a big one. While diversification and opportunity are awesome, to compare it on a dollar for dollar basis requires you to be disciplined and invest your money, like for like, as if you were paying interest. It can be tempting for renters to spend more on discretionary spending and not invest any excess funds.

Buy vs Rent – the results

When you buy a house to live in, although desirable to make money, it tends not be the absolute driver, there are softer issues at play such as shelter, desirable location, a house to bring children up. When you compare a like for like investment, residential property has historically performed well, however given elevated house prices and historically low interests rate, will the capital gains of the past match up to the future?

The forced saving that goes along with buying a property is a positive of home ownership, and over the long term, unless you are incredibly disciplined, will mean you save more.

The end decision ultimately comes down to the individual, if comparing from a pure investment point of view, residential property may not be the strongest alternative but considering the soft issues such as security and forced saving, it can come out on top. Also depending at what stage of your life you are in will also determine the best alternative, a younger person may opt to rent so they can live in a more desirable location and they want the freedom to go travelling, where someone else may love the forced saving and be content to live in a certain place and build equity in their property over the longer term.